Guru Ownership Trend

Guru Analysis for CVR Energy, Inc. (CVI)

CVR Energy, Inc. (CVI), a key player in the Energy sector, continues to attract institutional attention.

As of Q3 2025, a total of 7 Super Investors (Gurus) hold positions in the company, with a combined stake valued at approximately $1.65 B.

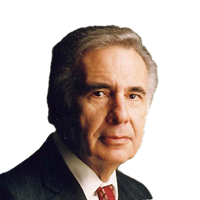

Top institutional holders include Carl Icahn and Renaissance Technologies.

Notably, Carl Icahn has expressed high conviction in this stock, allocating 28.10% of their equity portfolio to it.

Institutional sentiment is currently Bullish. This is evidenced by a $30.56 M net inflow during the quarter.

Recent activity highlights Paul Tudor Jones who opened a new position. Conversely, Jefferies Group reduced exposure by 35.6%.

| Portfolio Manager | % Portfolio | Activity | Shares | Value | Report Date |

|---|---|---|---|---|---|

| 28.10% | 70,418,471 | $2.57 B | Q3 2025 | ||

| 0.04% | Add 82.3% | 886,884 | $32.35 M | Q3 2025 | |

| 0.04% | New Buy | 609,028 | $22.22 M | Q3 2025 | |

| 0.05% | Reduce -24.0% | 439,040 | $16.02 M | Q3 2025 | |

| 0.00% | Add 3.7% | 114,489 | $4.18 M | Q3 2025 | |

| 0.02% | Reduce -27.9% | 49,939 | $1.82 M | Q3 2025 | |

| 0.00% | Reduce -35.6% | 7,730 | $281,990 | Q3 2025 |

| Report Date | Portfolio Manager | Activity | Share Change | % Portfolio Change |

|---|

| Report Date | Portfolio Manager | Activity | Share Change | % Portfolio Change |

|---|

| Report Date | Portfolio Manager | Activity | Share Change | % Portfolio Change |

|---|

| Portfolio Manager | Option Type | % Portfolio | Activity | Shares | Value | Report Date |

|---|

Key Holders

Top 5 by Value

Top 5 by Conviction

Recent Activity Breakdown (Q3 2025)

Guru Consensus (Q3 2025)

FAQs for CVR Energy, Inc. (CVI)

Major holders include Carl Icahn ($2.57 B), Renaissance Technologies ($32.35 M), Paul Tudor Jones ($22.22 M). According to the latest reported data, 7 tracked investment managers collectively hold approximately 72.53 M shares.

According to the latest 13F reporting period, sentiment appears Bullish (Net Buying). There was a net inflow of $30.56 M, with 3 managers increasing positions and 4 managers reducing holdings.

During the most recent reporting period, 3 managers trimmed their positions, while 1 fully exited CVI. The total reported sell value was $6.41 M.

Yes, 1 managers opened new positions in CVI, and 2 increased their existing holdings. The total reported buy value was $36.97 M.